TL;DR

- Bitcoin stalls under $112.5K, with upside targets near $124K and downside support at $106K.

- MACD golden cross confirms momentum shift, signaling possible continuation toward the $124K–$126K zone.

- Whale balances drop after steady accumulation, showing signs of profit-taking ahead of key resistance.

Bitcoin Tests $112,500 Resistance

Bitcoin is holding just below the $112,000 level, a price point seen as a key pivot for the next move. Analyst Lennaert Snyder explained,

“If Bitcoin reclaims $112,500, we can start looking at the upside again. Rejecting $112,500 triggers shorts.”

Charts shared by Snyder show upside potential toward $122,000–$124,000 if resistance breaks. A rejection at this level could push the price back toward $106,000 or even $101,000, where demand zones have previously provided support. These levels remain in focus as possible long entries if reversals occur.

$BTC consolidating near key $112,500 resistance.

If Bitcoin reclaims $112,500, we can start looking at the upside again.

Rejecting $112,500 triggers shorts.

$106,000 support & $101,000 rangelow are interesting for longs after reversals. pic.twitter.com/duUOIygF3m

— Lennaert Snyder (@LennaertSnyder) September 8, 2025

MACD Golden Cross Signals Momentum Shift

A separate analysis from ZYN pointed to a daily breakout from a falling wedge and a confirmed MACD golden cross. The crossover of the MACD line above the signal line is viewed as a bullish shift in momentum.

ZYN noted,

“$BTC MACD golden cross has happened. This is a momentum shift signal, and I hope you’re paying attention. Don’t be bearish now on Bitcoin.”

The move follows a rebound from $106,000 that carried the price past $111,000. If strength continues, projections place the next target range around $124,000–$126,000.

In addition, market focus is on upcoming US economic data, with Thursday’s consumer price index release and Friday’s jobs report. These numbers could influence Federal Reserve policy and liquidity flows. With Bitcoin trading near resistance, traders expect volatility around these events.

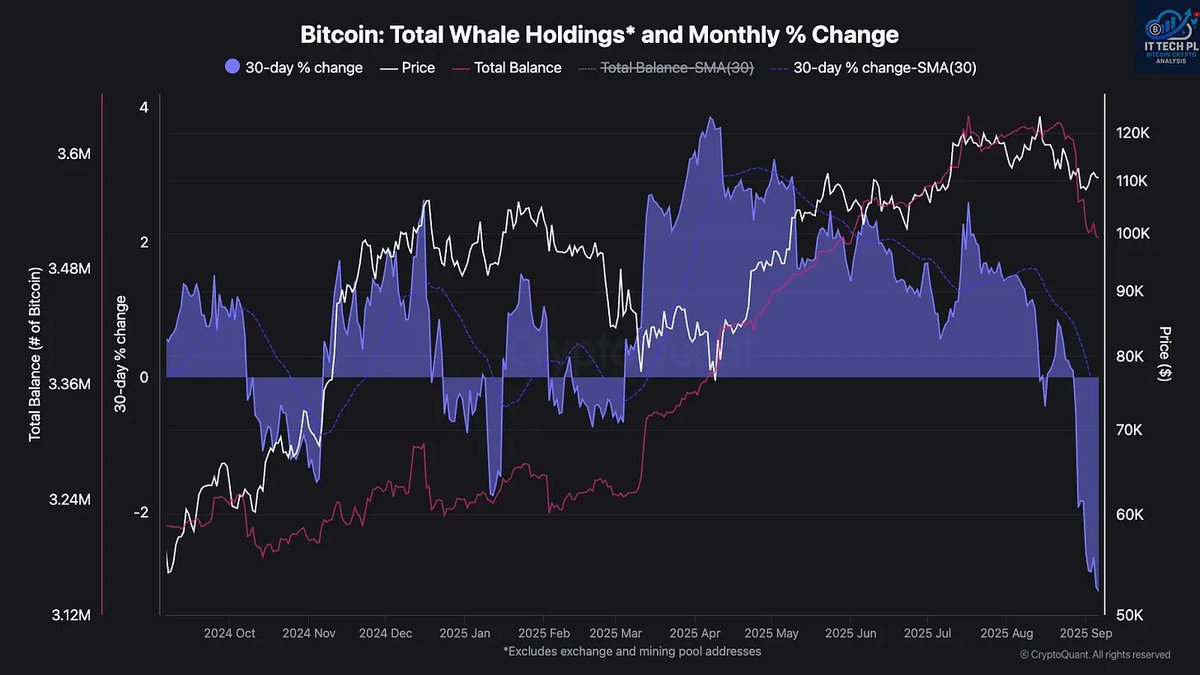

Whale Holdings Show Signs of Profit-Taking

Data from CryptoQuant analyst IT Tech shows a drop in Bitcoin whale balances after months of accumulation. Total holdings have fallen below 3.36 million BTC, with the 30-day change now negative.

IT Tech wrote,

“When whales reduce exposure, it often signals rotation or preparation for volatility.”

The pullback suggests some large holders may be trimming positions or locking in profits as Bitcoin approaches the $112,500 barrier.

Bitcoin has now tested decisively at the $112,500 mark. Upon breaking, $124,000 will likely be one-sided down just a game, and upon rejection, the asset will likely be sent back down to support in the range $106,000–$101,000. With technical momentum turning and macro data still upcoming, this next move could set how things will pan out for the weeks to come.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!