As BTC ▲0.09% finally is holding above $110K, hackers are making headlines today in the crypto world, with recent attacks on BunnyXYZ and the Venus protocol. On Ethereum and Unichain, BunnyXYZ suffered a confirmed exploit resulting in $8.4 million in losses—$6 million drained from Unichain and $2.4 million from Ethereum.

The attacker has since bridged all stolen funds over to Ethereum. The root cause appears to be a precision error in the protocol’s pool mechanics.

Hack Alert

@bunni_xyz has suffered an exploit on Ethereum & Unichain, with losses estimated at ~$2.3M – $2.4M.

The exploiter has exfiltrated funds to 0xe04efd87f410e260cf940a3bcb8bc61f33464f2b.

Attack txn: https://t.co/J0BTd7eSDe

Stay Vigilant! pic.twitter.com/xOdpzfcQb4

— FailSafe (@getfailsafe) September 2, 2025

The attacker reportedly performed a large swap to manipulate the price tick, then triggered repeated withdrawals to exploit the precision loss, before swapping back for profit. But Venus suffered even a bigger attack.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Venus Crypto Hack: $27 Million Stolen in Phishing Attack

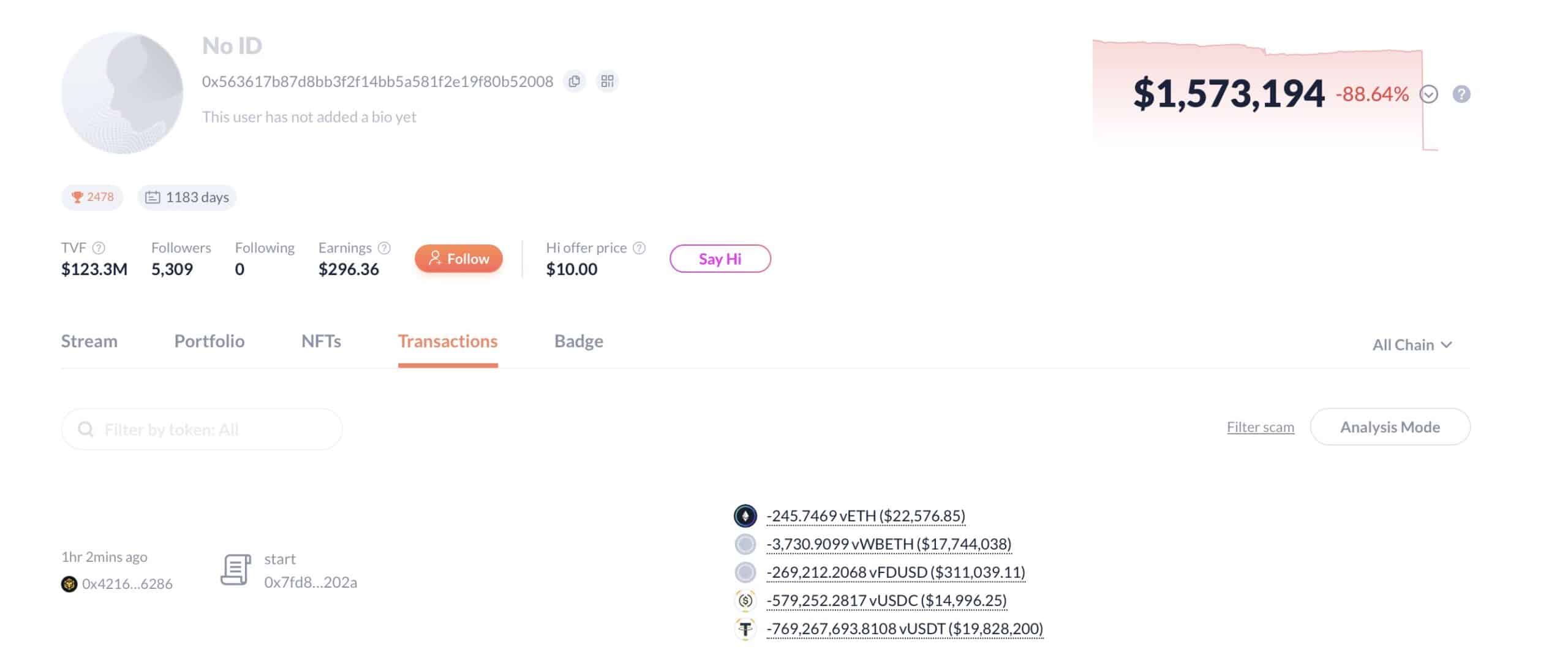

Meanwhile, blockchain data from the Binance Smart Chain shows that a major Venus protocol account (0x56…2008) was likely compromised, involving over $27 million. Security firm PeckShield reports that the user may have fallen victim to a phishing attack, unknowingly granting approval to a malicious address. This allowed the attacker to transfer the funds directly to 0xe04efd87f410e260cf940a3bcb8bc61f33464f2b.

(Source: DeBank)

The BunnyXYZ and Venus exploits serve as stark reminders that even minor technical flaws or user mistakes can lead to significant financial losses. These attacks highlight the growing threat of hackers in the crypto ecosystem.

Stay safe out there!

Crypto Market Flows: What’s Happening Beyond the Hacks?

The past week showed a clear return of institutional interest. Crypto ETFs pulled in around $2.5 billion, bouncing back from the previous week’s $1.4 billion in outflows.ETH ▼-1.89% led with $1.4 billion in new inflows, while Bitcoin ETFs added $748 million.

But prices didn’t fully follow that optimism. BTC ▲0.09% slipped from above $113,000 to below $108,000, and total crypto fund assets under management fell 7% to about $219 billion as the market cooled.

Meanwhile, SOL ▼-0.17% is once again outperforming both Bitcoin and Ethereum on the bounce from the recent market-wide pullback, trading around $203.60 (+3.19%). This steady relative strength is another sign of where momentum in the market is leaning: toward Solana and its growing ecosystem.

Stay tuned to our real-time updates below.

South Korea to Begin Global Sharing of Crypto Transaction Data in 2027

South Korea will implement the Organization for Economic Cooperation’s (OECD) Crypto-Asset Reporting Framework (CARF) starting next year. The country’s Ministry of Strategy and Finance officially launched the Information Exchange Agreement on 2 September 2025.

What does this mean for crypto investors? Data on foreign investors using Korean exchanges will be shared with their home tax authorities, and records of Koreans trading overseas platforms will be reported to Korea’s National Tax Service.

According to local media, a Ministry official said, “This is a separate matter from taxation.” The official added, “The purpose is to establish detailed regulations for implementing the Virtual Asset Information Exchange Agreement.”

The move aligns South Korea with a 48-nation pledge to activate CARF by 2027. South Korea’s adoption of cross-border reporting of digital transactions will close offshore loopholes.

SharpLink Boosts Ethereum Holdings to 837K ETH Worth $3.6B

SharpLink has significantly expanded its Ethereum position, acquiring 39,008 ETH at an average price of around $4,531. This brings its total holdings to 837,230 ETH, valued at approximately $3.6 billion as of August 31, 2025.

Key Developments (Week Ending August 31, 2025)

- Raised $46.6 million through its at-the-market (ATM) facility

- Added 39,008 ETH at ~$4,531 average

- Earned 2,318 ETH in staking rewards since June 2 launch

- ETH concentration rose to 3.94, up 97% since June 2

- Maintains over $71.6 million in cash reserves for future deployment

In related accumulation news, Bitmine purchased another 153,075 ETH (worth ~$668 million) last week, bringing its total Ethereum holdings to 1,866,974 ETH (~$8.15 billion).

The post [LIVE] Latest Crypto News, September 2 – Hackers Shake Market as Bitcoin Holds $110K: $8.4M BunnyXYZ Exploit and $27M Venus Crypto Hack appeared first on 99Bitcoins.