Google blockchain is here, and it’s looking to dominate the market. In a post on LinkedIn, Rich Widmann, head of Web3 strategy at Google, revealed new details about the Google Cloud Universal Ledger (GCUL).

He described GCUL as the culmination of years of internal R&D to compete with other top cryptocurrencies. It is designed to be a credible neutral infrastructure with support for Python-based smart contracts.

“Any financial institution can build with GCUL,” Widmann said, noting that while Tether won’t use Circle’s blockchain, Google is positioning itself as the neutral layer that removes those barriers.

DISCOVER: Top 20 Crypto to Buy in 2025

Is Google Building a “Planet-Scale” Blockchain? Should You Invest in Alphabet Stock?

The blockchain wars among fintech giants are heating up. Stripe is building Tempo, a payments-centric chain tied to its $1.4 trillion processing rails, while Circle has launched Arc, designed around its USDC stablecoin.

Google’s pitch is different: rather than locking adoption to a single corporate ecosystem, GCUL is meant to be shared plumbing—much like Ethereum or Polkadot—and a ledger financial institutions can adopt without being tied to a competitor’s core business.

That positioning could be key to adoption, particularly if banks, fintechs, and payment providers are unwilling to rely on rivals’ blockchains.

According to Widmann’s post, GCUL aims to be “planet-scale,” supporting billions of users and bank-grade functionality.

- Stripe’s Tempo: focused on merchant flows.

- Circle’s Arc: stablecoin-native chain with FX and settlement tools.

- Google’s GCUL: open infrastructure with Python smart contracts and institutional-grade tokenization.

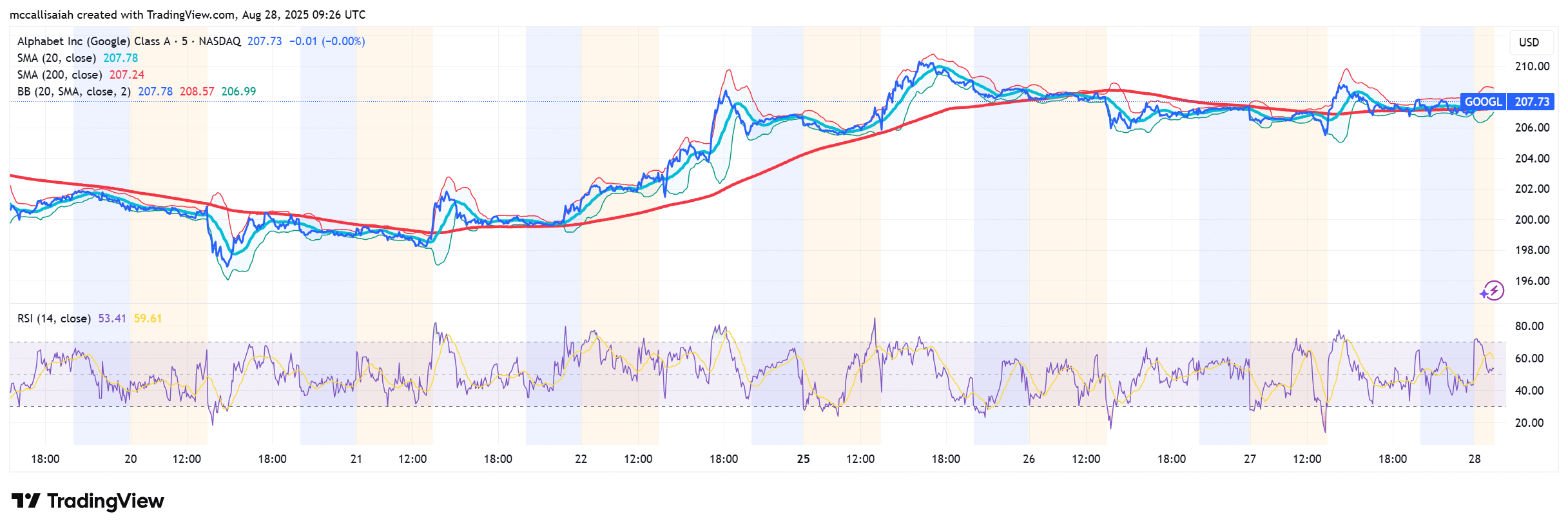

If Google is able to capture even a portion of Web3, that’s $4Tn market that they can play with. Maybe it’s time to load up on Alphabet stock?

The timeline also matters. Circle’s Arc is already in the pilot stage, Stripe plans a 2026 rollout, while GCUL is now in integration testing with broader trials in 2026.

DISCOVER: 20+ Next Crypto to Explode in 2025

Here’s What Comes Next for GCUL

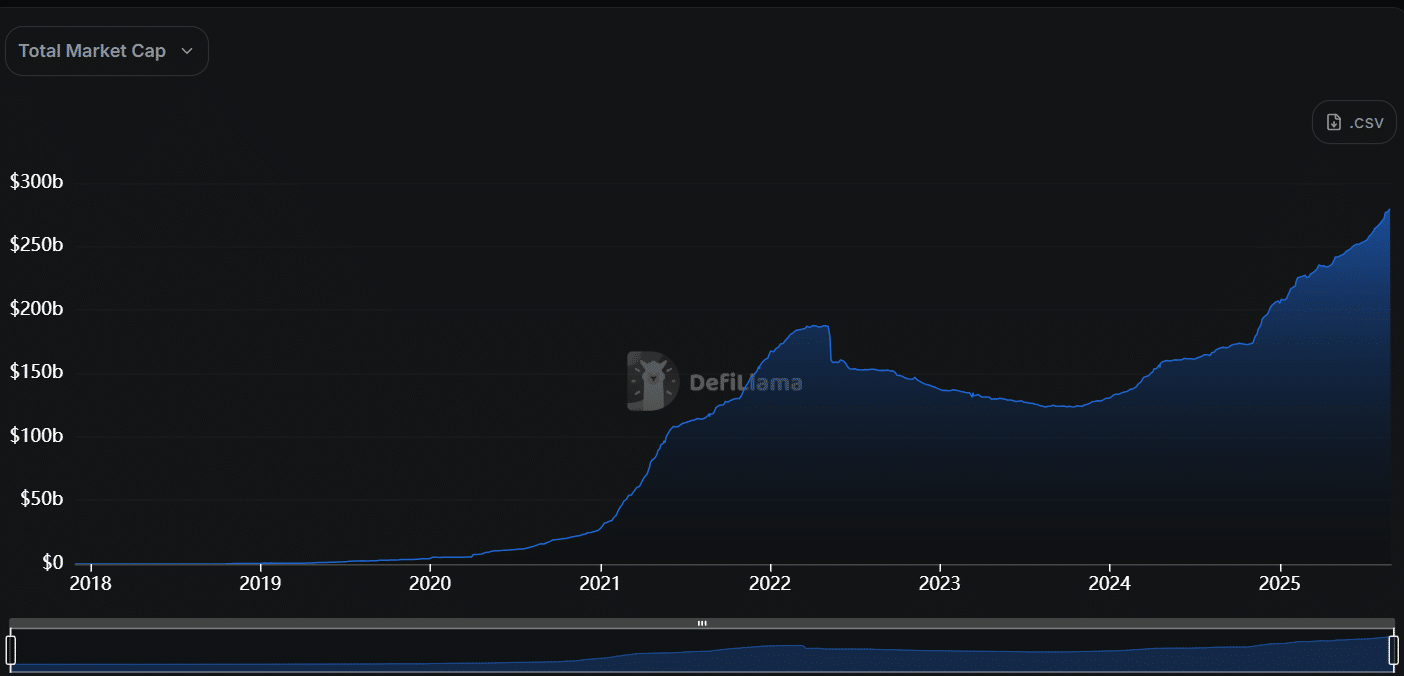

Stablecoins remain above $200 billion, underscoring the demand for trusted settlement rails. Layer-1 DeFi activity has grown 35% YoY, even amid broader market volatility. If GCUL can position itself as a neutral base for these flows, it could capture a meaningful share of tokenization and settlement volumes.

Google plans to release technical details “in the coming months” as it works toward a full-scale rollout with CME and other partners.

The big question is whether institutions will embrace Google’s claim of neutrality or if reliance on a tech giant will simply replace one form of centralization with another.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Google blockchain is here, and it’s looking to dominate the market. Rich Widmann, head of Web3 strategy at Google, revealed new details.

- If Google is able to capture even a portion of Web3, that’s $4T market that they can play with. Maybe it’s time to load up on Alphabet stock?

The post Now That Google Blockchain is Here, Should You Invest in Alphabet Stock? appeared first on 99Bitcoins.